- Our agenda is peer-researched with the industry and Private Banker International to ensure we cover the topics that matter to you.

- Hear the latest trends, case studies and strategies on consumer duty, transforming technologies, data and customer experience and more.

- Listen to the top industry players as they deliver their vision for 2025 and beyond.

- Discover potential partnerships with relevant solution providers to successfully transform your business.

- Connect and grow your network with senior level experts from across the wealth management industry and discover potential future partnerships.

Who attends?

We are known for bringing all senior digital wealth managers of today to the heart of London.

Be in the same room as leading

- Heads of Strategy

- Chief Operational Officers

- Presidents of Digital Assets

- Heads of Technology’s

- Senior Vice Presidents of Private Clients

From the UK’s top Private Banks and Wealth firms. Our unique event provides exclusive opportunity for rich, personal, and in-depth conversations and tactics to transform your business.

The meeting place for innovation

Take away exclusive, first-hand insight from some of the leading minds and many solution providers within wealth management who will be showcasing their digital platforms, software and solutions which are tailored to help your business succeed.

Find out what you could be a part of:

WHAT TO EXPECT FOR 2025?

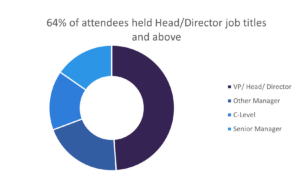

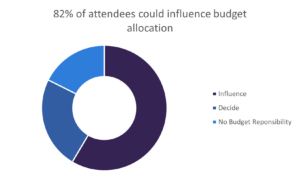

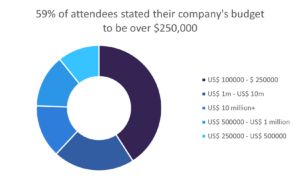

| 250+ Attendees | 25+ Exhibitors to meet | 25+ Talks from high-level speakers | 90% Attendees at Director+ level |

| 250+ Attendees | 25+ Exhibitors to meet | ||

| 25+ Talks from high-level speakers | 90% Attendees at Director+ level |

Back

Back