Archives: Agenda

The Application and Status of AI in the Insurance Industry

- Automation of Routine Tasks: Accelerating claim processing and optimizes underwriting using data analysis and machine learning.

- Improved Customer Service: Virtual assistants and chatbots provide quick responses to customer inquiries.

- Fraud Prevention: AI detects fraud by analyzing claims data and utilizing image recognition for assessments.

- Risk Management: AI helps insurers predict risks using data from weather and demographics.

- Personalization: AI enables tailored insurance solutions by evaluating individual behaviors, such as dynamic premiums based on data from wearables or vehicles.

Investing in Behavioural AI to Revolutionise Fraud Prevention

-

Using AI-driven behavioural analytics to detect emerging fraud and scam techniques

-

Improving customer trust whilst reducing friction through behavioural intelligence

-

Proactively detecting mule accounts before the damage is done

Lunch and Networking

Private Dinner by Appian Europe Ltd

Unlocking the Future of Payment Investigations: Automation, AI, and Innovation

Close of Conference & Drinks Reception

Key Pillars of Digitalization and Omnichannel Strategy In Financial Services

- Highlighting the potential initiatives of AI in transforming both customer experience and operational efficiency

- Examples of AI summaries and Conversational AI

- Leveraging AI to save time, ensure consistency, and improve the quality of customer follow-ups and freeing up advisors to focus on deeper customer engagement

SESSION 4: FUTURE OPPORTUNITIES

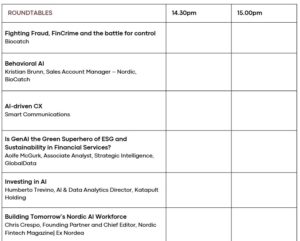

A Series of Sector-Specific Roundtables (Sponsor-focused)

Interactive roundtable sessions offer a unique opportunity to come together with your peers to share best practice and develop solutions to critical challenges facing the industry as a whole. Hosted by industry experts and each focused on a single issue, roundtables are an exciting, interactive way to build your personal network and learn from the experience and expertise of others. Each roundtable session lasts for 30 minutes, and delegates may attend up to 3 roundtables.