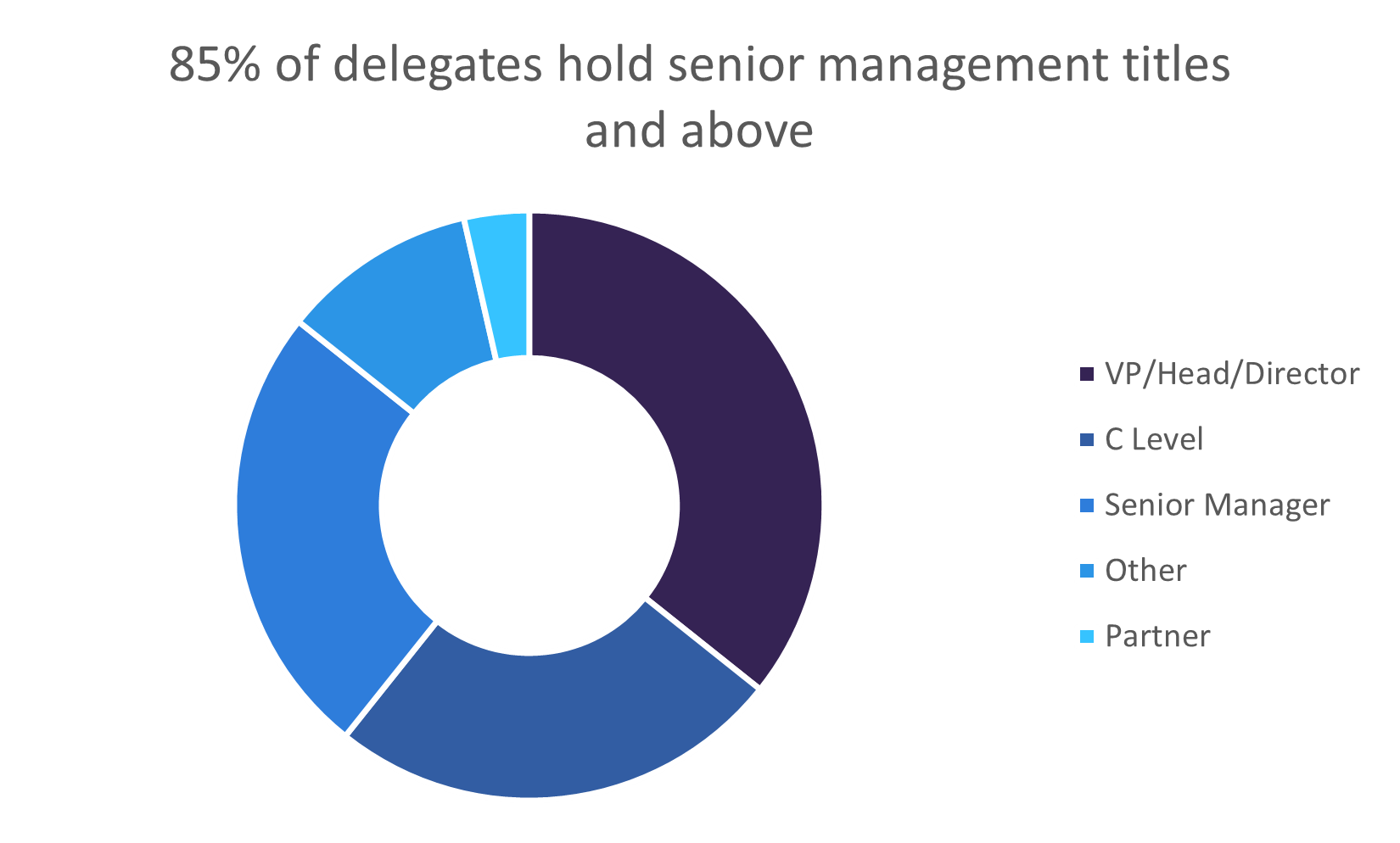

A fantastic network of your peers and colleagues

The 10th edition of the Motor Finance Europe Conference & Awards will bring together C level execs from Banks, Captives, Lenders, Challengers, lending platforms, Government Agencies, SMEs, Brokers and advisors to debate the strategies for growth in the automotive financing sector.

Discover key insights into the very latest regulatory requirements, technological innovations and strategic developments. Take away actionable strategies, and how best to implement them into vehicle financing with both maximum efficiency and minimal cost.

The event covers the European vehicle leasing and financing market and will examine how car ownership can be enhanced, models for business growth for both new vehicles and used cars, the future of the electric car market and how digital innovations are driving customer loyalty.

2023 Testimonials

“The Motor Finance Conference in Vienna was a perfectly organized gathering of the Motor&Finance&Mobility&Technology-Experts with a wide range of expertise. The presentations on the different topics were highly interesting and matched with lively discussions between panelists and participants.” Klaus Entenmann, Chairman of the Board, Mercedes-Benz Auto Finance

“It has been an honor to contribute towards the industry best practices shared at the motor finance conference. Not only have we been inspired by the insights and speakers, but we were also able to engage with industry experts and leaders with whom we will collaborate on our way forward. The entire event was planned and executed by your team seamlessly and well thought through.” Bejamin Eule, Director Global Services, Daimler Truck Financial Services GmbH

“Motor Finance Europe is an excellent event, we’ve been two years running and both times have had a fantastic opportunity to network with colleagues and partners across the industry, see different perspectives and ways of working to tackle the current challenges within the motor finance industry and then to top of off an excellent evening event to celebrate the exceptional achievements and initiatives of those in our sector. We’ll certainly be back.” James Standing, Finance & Leasing Development Director, AutoTrader

The team behind Motor Finance Europe is doing a great job to continuously gather senior leaders of our industry to meet and discuss the most pressing issues. Both presentations and interactive networking sessions are perfectly balanced and build an idea platform to meet & exchange with existing and new industry contacts. Christopher Ley, Partner, Berylls Strategy Advisors

What to expect for 2024?

- Watch cutting edge presentations and gather expert insight from 25+ industry speakers.

- Discover the latest innovation and updates from a remarkable agenda.

- Engage in panel discussions and ask your questions directly to leading experts.

- Enjoy two days of invaluable networking opportunities.

- Be part of timely and relevant conversations and hear about topics that are trending in the industry.

- Celebrate the industry and connect with peers and colleagues at our prestigious awards night.

Back

Back